The "Asian CEO Brand Globalization Strategy Program," launched by Kotler Marketing Group (KMG), is a practical strategic program specifically designed for CEOs, executives, and investors of Asian enterprises. Unlike traditional business school EDP program on globalization, its core curriculum is derived from the practical models and lessons learned from dozens of Chinese enterprises that have successfully expanded globally—all of which were clients deeply served by KMG over the past 20 years. The combined sales of these enterprises exceeded $120 billion in 2024, and their insights, experiences, and models offer highly inspiring and practical value for companies embarking on global expansion.

To ensure cutting-edge relevance and practicality, the program meticulously integrates hybrid learning activities. These include lectures and interactive sessions with over 10 senior KMG global partners and master mentors, CXOs from successfully globalized enterprises across various industries, and field research activities in key frontline markets like the Middle East and ASEAN regions.

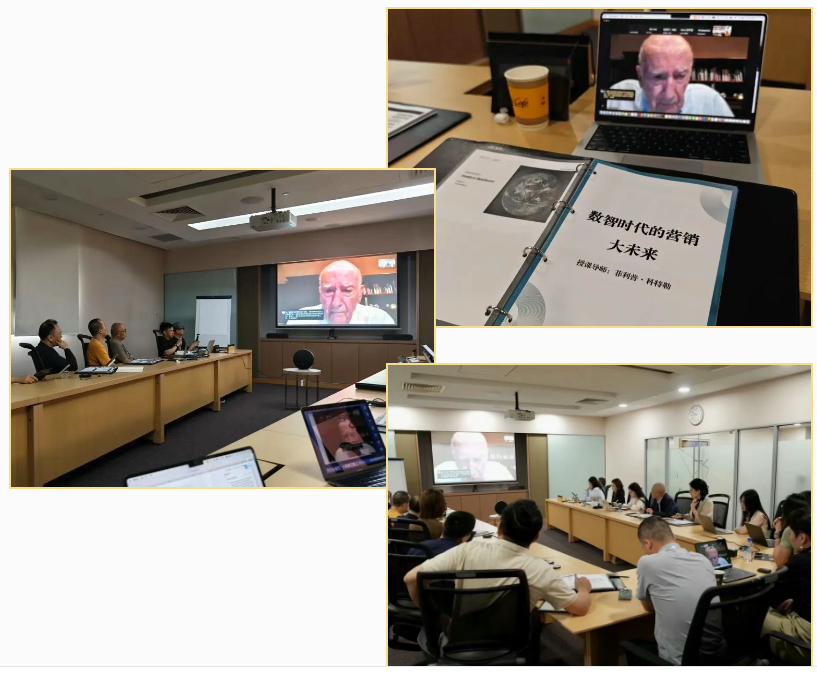

From May 15-18, 2025, the inaugural Kotler Global CEO Program officially commenced in Singapore. Five expert professors, led by Professor Philip Kotler, delivered high-intensity, knowledge-rich lectures and discussions to nearly 30 founders and executives from China, Singapore, Japan, and Indonesia. The Program covered critical topics such as geopolitical business strategy, opportunities in the Asian market, global business models, winning in local markets, AI-driven transformation of global marketing and business models, and diversified value innovation. It provided participants with systematic methodologies and guidance to examine growth challenges and opportunities, develop international business expansion strategies, and identify their enterprises' next growth curve.

Session 01: Mega Marketing in the Age of AI

Instructor: Philip Kotler- Recipient of the Thinkers50 Lifetime Achievement Award, ranked among the world's top three management thinkers.

- Widely recognized as the 'Father of Modern Marketing'.

-Co-founder of Kotler Marketing Group.Professor Philip Kotler elaborated on his recent insights from four key perspectives:

1. Free Trade and Tariff Policies

2. Mega Marketing

3. Entrepreneurial Marketing

4. AI-Driven Transformative Marketing

Professor Kotler posits that in today's era of geopolitical tension, businesses operating internationally often face barriers such as "closed markets"—a challenge prevalent across various industries and countries. To overcome this, companies must expand the boundaries and perspectives of traditional marketing. Enterprises need to adopt a Mega Marketing strategy, integrating two new Ps, Power and Public Relations, into the classic 4Ps framework. Power serves as a push strategy, while Public Relations acts as a pull strategy. Business leaders must understand and navigate the influence of power on policy, while simultaneously building value consensus with stakeholders through PR to form a broad community of shared social interests. Mega Marketing provides executives with a compliant and effective approach to address intensifying global and domestic competition, as well as market access barriers.

Based on his latest book, 'Transformative Marketing,' Professor Kotler also shared insights on the application of AI in business operations. He emphasizes that as technology accelerates, companies cannot rely solely on technological advancement. Instead, they must leverage new technological possibilities to create more human-centric and emotional value. H2H (Human-to-Human) Marketing is the key to success in the AI era.

Session 02: The New Asian Order

Instructor: Parag Khanna

- Renowned global strategy advisor and futurist, World Economic Forum "Global Young Leader".

- Former Senior Research Fellow at the Lee Kuan Yew School of Public Policy, National University of Singapore.

- Fellow at the Brookings Institution, Senior Geopolitical Advisor to the U.S. Special Operations Command.

- Recognized as one of the "75 Most Influential People of the 21st Century" by Esquire.

Professor Parag Khanna argues that the geopolitical landscape is being reshaped into a "multipolar" world, not a "Chimerica" duopoly, with Global South and Asian nations rising rapidly. Consequently, the art of balance—"refusing to choose sides"—has become a key survival philosophy for emerging global markets.

When a country considers who should build its data centers, it doesn't think about siding with Huawei or Google but rather, "what is best for us." It will diversify orders among multiple suppliers. This win-win strategy has become an international consensus because no country wants to become a "vassal," and many have historical lessons that make them wary of powerful nations.

This national mindset permeates every corner of international business, where "security assurances" in a geopolitical context can sometimes imply deeper control.

For Chinese enterprises, it is necessary to abandon the outdated mindset of "exclusive cooperation." Instead of trying to incorporate other countries into a "sphere of influence," they must truly understand and respect their autonomous choice to "not choose sides." Offering diversified, inclusive solutions, committing to deep localization, and constantly evaluating whether business actions might trigger concerns about "becoming a vassal" in host countries are crucial. This is not merely risk avoidance but the key to building lasting global trust and achieving a win-win paradigm.

Session 03: Building a Global Marketing Strategy and System

Instructor: Cao Hu- Global Partner, Kotler Marketing Group; CEO of Greater China and Singapore.

- Internationally renowned expert in marketing strategy and brand strategy.

Cao Hu believes that in the next five years, Chinese enterprises with a "domestic foundation + TBMPSS" framework will be highly valuable. TBMPSS stands for: T (Technology), B (Brand), M (Marketing Communication), P (Product), SS (Sales and Service).

Reviewing global economic history and brand development, Cao Hu found that global GDP centers and brand centers highly overlap. Therefore, in the next 5-10 years, a significant number of Chinese and Chinese-founded brands are poised to become international and global brands. The rise of the "Chinese economy" will become a major trend and the most dynamic commercial force in the global market.

However, Chinese entrepreneurs must clearly realize that going global is by no means a simple "dimensional reduction strike" or replication, but requires meticulous reconstruction.

Successful globalized enterprises employ two differentiated models—"Augmentative Innovation and Frugal Innovation"—for localized innovation in different markets. Through real-case studies in consumer electronics, software, food and beverage, cosmetics, automotive, medical technology, FMCG, and other industries, Cao Hu demonstrated his winning innovation model: "achieving 80% of the functionality at 20% of the cost while delivering 120% of the perceived value." He further proposed a "dual-drive" operational approach combining "product innovation and business model innovation." Finally, he deconstructed practical approaches for the consumer electronics, medical technology, and content industries in emerging countries, as well as methods to develop differentiated enterprise value curves using the 3Vs framework.

Session 04: Growth and Breakthrough in the Context of Globalization

Instructor: Wang Sai- Managing Partner for Greater China and Singapore, Kotler Marketing Group; General Manager, Growth Strategy.

- Growth strategy expert, guiding leading Chinese enterprises and CEOs in marketing strategy innovation and growth.

- Director of the Growth Laboratory at the Business Model Research Center of Tsinghua University.

Wang Sai stated that the core of growth strategy lies in dynamic balance—managing certainty and uncertainty, science and art, strategic layout and tactical breakthrough. Building sustainable competitive advantages requires essential insights and scenario-based decision-making. Growth isn't just about increasing market share or revenue; it's about enhancing company value through structural advantages (e.g., monopolistic edges, differentiated models), exemplified by Coca-Cola's mindshare monopoly or P&G's shelf-space dominance.

"Layout" and "Breakthrough": Layout involves strategic choices (which fields to enter), while breakthrough addresses specific customer pain points (e.g., Xiaomi's disruption of the traditional market with high cost-effectiveness). Strategy is not about drafting rigid blueprints (e.g., "five-year $10 billion plans") but about dynamic decision-making that integrates enterprise resources, external opportunities, and core essential issues. Enterprises must avoid "bad strategies" that set goals without executable paths, which can lead to significant pitfalls. Finally, he deconstructed how to build a sustainable "Growth Map" using practical cases from KMG's years of consulting experience.

Session 05: Global Strategy and Tactics for Chinese Enterprises Going Overseas

Instructor: Zhou Hongyi

- Adjunct Professor, National University of Singapore (NUS) Business School.

- Special Appointed Professor, Peking University's National School of Development (BiMBA).

- Former Senior Executive at 6 Fortune 500 Technology Companies.

Professor Zhou Hongyi stated that whether for product, technology, or capital globalization, going global necessitates strategic intent and execution capability. First, a clear strategic intent is paramount. Second, a cooperative mindset is essential, collaborating with various partners overseas across sales, marketing, R&D, supply chain, capital, and government relations.

Outstanding enterprises typically possess a clear strategic intent for globalization and achieve growth by finding partners with complementary attributes overseas. Gradually, they locate each business activity or supporting function in its optimal global location, building core competitive advantages.

Professor Zhou also elaborated on how enterprises can create glocalized operational models for product globalization, plan market entry strategies tailored to local conditions to win battles on the ground, and continuously advance the development of global organizational capabilities and "corporate DNA," among other highly valuable topics.

Session 06: Closed-Door Seminar: Barclays Bank

- Barclays Bank, one of the world's largest banks and financial institutions, provides extensive services primarily in banking and investment.

- With a significant international presence across Europe, the Americas, Africa, and Asia, it is a major global financial services provider operating in about 60 countries with approximately 140,000 employees.

- By assets, Barclays is one of the largest financial banks in the UK.

Economists from Barclays shared insights on: changes in international trade rules, analysis of U.S. political strategies, currency and long-term exchange rate forecasts, economic and monetary strategies of Asian countries, economic development trends of core economies, response strategies and opportunities for Chinese enterprises, shifts in global supply chains, capital investment trends, development insights for specific industries, and digital assets.

In a keynote speech titled "How Chinese Enterprises Can Leverage Singapore's Strategic Advantages," a partner from Dentons Rodyk & Davidson LLP discussed: Singapore's Global Investor Programme, family office structures and systems, establishing an international wealth management center for enterprises, and Singapore's "revolving door strategy" amidst tariff wars. Against the backdrop of escalating Sino-U.S. trade tensions, Singapore's "neutral" role and mature free trade network provide flexible solutions for Chinese enterprises to navigate U.S. tariff barriers, making it a key hub for risk mitigation and supply chain optimization.

Session 07: Entrepreneur International Market Operation Seminar

CEOs, executives, and capital professionals with extensive overseas experience were invited to engage in in-depth discussions with participating entrepreneurs, addressing key questions about global expansion from an external perspective:

- When building an overseas team, under what circumstances should Chinese personnel be deployed? When should local foreign personnel be hired?

- How can Chinese personnel be supported to integrate locally?

- How to retain high-quality international talent?

- What strategies, market approaches, and management models have Chinese enterprises adopted for expanding into Europe? What are the considerations for advance or retreat strategies?

- How to achieve multicultural integration when going global?

- What are the operational models of Chinese fintech companies and capital platforms overseas? What opportunities exist? etc.

Keynote Speaker: Zhang Zhouchuan

- VP of Overseas Sales at OPPO.

Zhang Zhouchuan's Insights:

OPPO operates in over 70 countries, focusing on consumers and respecting local cultures. It is a company guided by the cultural value of "Benfen" (staying grounded), with extensive and successful international market practices. Market entry strategies must clarify "regional expansion paths," such as starting in regions with cultural similarities and analogous market structures before expanding further. Localized product customization requires deep upfront user research, identifying areas for improvement throughout the user journey. Channel models must also be tailored to each country. Enterprises should build strategic centers, resource and capability hubs, divide markets into different "theaters," and create "global operational teams."

Keynote Speaker: Zhong Tingyi

- Partner at Asia Food Growth Fund; CEO of Singapore's Weichipin Food Group.

Zhong Tingyi's Insights:

Going global must be an active strategic choice and resource allocation decision, not a passive risk avoidance measure. Similarly, it requires long-term commitment to core regions, not short-term experimentation. Localization should embody a "local champion" strategy. The experiences of foreign enterprises in China are instructive: the localization transformations of brands like Kraft and Danone prove that only deep integration into local markets leads to success.

The Southeast Asian market is particularly complex. Success stories like OPPO's in wholesale markets and Weichipin's coffee brand in Cambodia (achieving market share comparable to Nestlé) confirm the effectiveness of the "local champion" strategy. To succeed in localization, one must immerse themselves in the market, respect local cultures, and learn from failures to have a chance at becoming a true local champion.

Keynote Speaker: Zhou Zhou

- Founder of Kitai; former Head of Shopee's O2O Product Line.

Zhou Zhou's Insights:

Analysis of the "three multiples" characteristics of the Southeast Asian market: multi-country operations requiring differentiation, multi-religious cultural influences, and population diversity. Using Shopee's successful operational practices as a case study, he addressed real-market challenges.

Southeast Asia requires a distinct strategy per country: Reject "one-size-fits-all" approaches and deeply adapt to each country's economic, religious, and cultural differences. Examples:

- Data-driven: Shopee's food delivery business relies on algorithms to optimize grid division and rider dispatch (e.g., achieving 25-minute delivery in Ho Chi Minh City).

- Cultural respect: From Halal certification to festival marketing (e.g., Eid al-Fitr in Indonesia), strengthening local brand identity.

- Long-term investment: Identifying high-potential segments in demographic dividend markets, balancing scale and efficiency.

Keynote Speaker: Gary Ang (Weng Lingguo)

- Executive Partner at AGl & Associates Pte Ltd.

- Former Senior Executive (Vice President and above) at ANZ, Royal Bank of Scotland, Citibank, DBS Bank.

- Former CEO of Siemens Financial Services Asia.

Gary Ang's Insights:

Singapore's strategic value lies mainly in its strong national brand and advantages as an ASEAN hub. Chinese enterprises face dilemmas in cross-cultural management: They must sincerely acknowledge and accept cultural differences, yet not simplistically attribute all management issues to culture, thereby masking real operational problems.

Unlike domestic operations, international ventures require building robust financial risk management capabilities, primarily addressing foreign exchange exposure and regional treasury arrangements. Globalizing enterprises need to balance localization and globalization, focusing on how to share value with local societies rather than just selling products. They must also pay attention to organizational flexibility and adopt a gradualist approach to structural development.